Long Trader Makes Money from Falling Prices!

Dec 7, 2011 at 6:03 pm in Tips and Strategies by

I hope my sensationalist headline got your attention, and I bet you’re wondering by what kind of strange alchemy a long trader can make money from falling prices. But first, why would he want to?

Why Try to Make Money from Falling Prices by Going Long?

If you know that a market is about to fall, you go short, and it’s as simple as that — if you know that a fall is imminent. Well, you can’t know for sure that a market will fall, and you’re on dangerous ground when the longer-term potential in the current cheap-stock environment is massively on the upside. It may take only a few words from Angela Merkel to make all those dog stocks perform an about-turn and shoot for the stars.

That’s why I’m biased towards the long side, but mindful of the fact that my stock picks could (and probably will) fall before they rise. So the question is: how, as a long trader, can I make money when prices fall?

What You Don’t Lose on the Way Down, You Gain on the Way Up

Making money (eventually) from falling prices works like this:

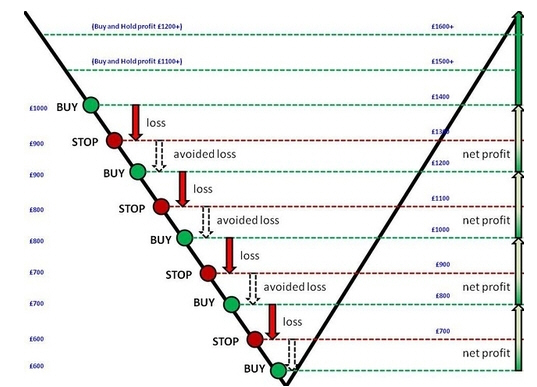

Suppose you start with trading resources of £1000, you establish a £1-per-point position in a stock or other financial instrument priced at 1000p, and you reduce your risk to £100 by placing a stop order at 100 points below your buy-in price.

Suppose you start with trading resources of £1000, you establish a £1-per-point position in a stock or other financial instrument priced at 1000p, and you reduce your risk to £100 by placing a stop order at 100 points below your buy-in price.

When the price falls, your position stops out thereby leaving you with £900 worth of trading resources. When the price falls further — let’s say by the same amount — you establish a new position at 800p having sat out the fall from 900p to 800p. If your position stops out again for another £100 loss, you wait for another equivalent fall before buying in again.

While taking only 50% of the losses on the way down, you stand to benefit from 100% of the recovery profits on the way back up, so by the time the prices gets back to the original 1000p mark, you are in profit by half of the downward losses compared with the “buy and hold” investor who has merely broken even. Here it is as a picture:

(figure taken with permission from the book “Position Trading” [Second Edition] by Tony Loton)

Note that this is a highly stylised example in which I have chosen an arbitrary stop-out risk of £100 each time and in which I have assumed that we will capture exactly half of the losses in the form of recovery profits. Nonetheless, it shows in theory how a long-only trader can benefit (eventually) from falling prices; and it is the idea behind my Stop-Out List.

In the real world it won’t work out quite like this. It could turn out better, could turn out worse, which brings me to…

What it’s not, and when it fails

Note that this is not averaging down, which implies making additional “investments” on the way down in the hope of breaking even sooner (and ultimately making more profit) on the way up. It’s not as risky as that because you are not throwing more and more good money after bad on the way down. In fact: if your chosen stock goes bust, you will have lost only a proportion of the amount that the “buy and hold” investor would have lost and much less than what the “average down” investor would have lost.

Nor is this the same as keeping your original position open while periodically lowering your stop order — which is generally considered to be a very bad idea. The idea here is to step out of the way of some of the losses on the way down, but to profit from the whole of the lost ground on the way back up. But is does have a flaw:

If you don’t make the final catch to take you into position at the bottom, and the price stages a major recovery, your efforts may well have been in vain.

That said — and it has been said, by some of my previous blog followers — the fact that you hopefully missed much of the loss on the way down means that you can afford not to have made your final catch at exactly the bottom. Those missed losses give you a little extra leeway in timing your ultimate re-entry.

The “fear of missing out” can also be mitigated by running many such positions so that you at least catch some of them correctly.

Another “Financial Trading Pattern”?

Having shown how this technique can work, and explained how it can also fail, this article may be worthy of an honorary inclusion in my compendium of Financial Trading Patterns. Maybe I could call it the “Catch a Falling Knife” pattern.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.