Trading Trail #30: Closing in on the FTSE

Jan 19, 2012 at 4:17 pm in Trading Diary by

I’ve not posted about my “Trading Trail” position trading reference account for over a week, and you might be wondering why. Well, I figured that readers might not be that interested while I’m on a losing streak — or what I call my Getting Into Position phase. No one likes a loser, and everyone likes a winner, so I decided to hold off a little until I was winning — at risk of damaging my rep by reporting only when the going is good. I resolved that until I had something for you to get excited about, I’d post an update no more than once a week with an equity curve and / or portfolio snapshot and something ‘educational’ relating the account.

I now have an update for you, it’s positive one (relatively speaking), and it leads me to make some educational observations as follows.

Closing in on the FTSE

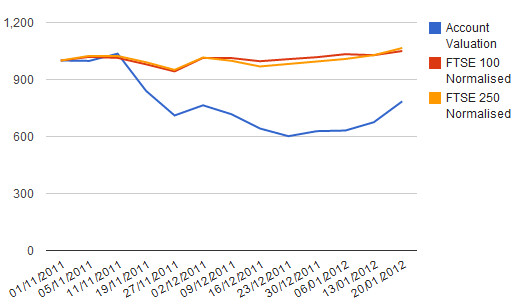

I’m not too bothered what the FTSE does as long as I make money, but you may remember that I started plotting my portfolio value against the FTSE 100 and 250 indices. Until now it hasn’t made good viewing because when the FTSE falls… my portfolio falls faster (and I’ll tell you why shortly). However, when the FTSE rises, my portfolio should rise faster, as indeed it is in the equity curve that I snapshotted — is that even a real word? — at 1:30pm today. I would have closed the gap on the FTSE by an additional £35 if I hadn’t sold Afren prematurely; so in future I must remember to run my profits.

Why does my portfolio fall faster than the FTSE?

When the markets are bearish, my diversified holdings will tend to fall in value across the board. Also when markets are bearish, that’s when I tend to establish new positions, and each new position incurs an immediate frictional cost because of the bid-ask spread. These frictional costs can be compounded by my new positions stopping out and me having to re-establish them, albeit at an even lower price.

When the markets are bullish I have nothing much to do except raise my stop orders, so there are no fictional costs. The rising tide lifts all my boats, and leverage helps them rise faster.

(Not) Calling Capital Spreads

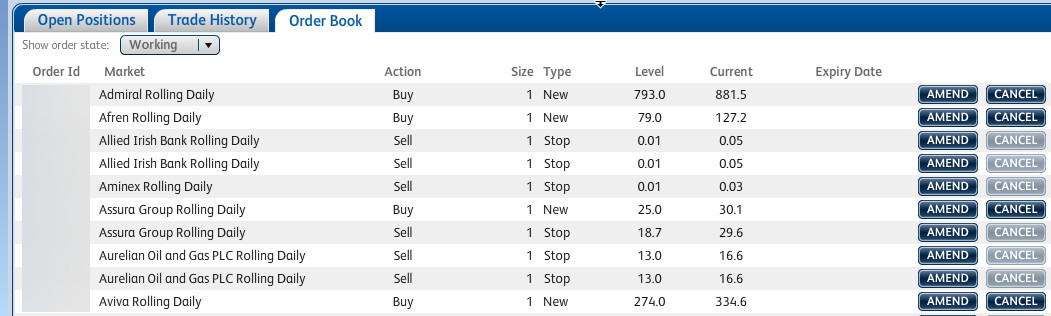

As you can see in the limited portfolio snapshot below, many of the markets I am holding are now set to Call on Capital Spreads, which means they can no longer be traded online. This leads me to share two tips with you below.

Tip #1, Don’t Stop Too Soon: Since the markets maked “Call” may never again be available for trading online (or at all), once I’m out of position I may have no hope of getting back in. It leads me to trail the stop orders on these stocks even more cautiously, because… when they’re gone, they’re gone.

Tip #2, Use the Order Book: It appears that I can’t trail my stop orders at all on these “Call” positions via the Open Positions tab, even if I wanted to. But there’s nothing to stop me adjusting my stop orders (cautiously) by pressing the Amend button against each one in the Order Book tab. Taken to its logical conclusion: if you really want to close a position, and even the Order Book won’t let you do so, just Amend it to place the stop order as close as it will go. You should stop out of the unwanted position soon enough.

Guaranteed Profits, Not Guaranteed Losses

I’m not a big fan of paying for guaranteed stops as a means of guaranteeing my losses, except where the price is so high that a fall to zero (or even by 50%) would wipe out my entire account on a £££-per-point basis. When it comes to securing a profit, it’s a different matter.

With TUI Travel showing a profit of more than £44, the £1.43 cost of guaranteeing £31.50 of that profit is small beer. It’s a similar story with Mitchells & Butlers (£37 profit, £16.70 guaranteed) and Tullet Prebon (£32 profit, £8.10 guaranteed).

Note that Capital Spreads is better than some spread betting companies in allowing you to guarantee the stops on your existing positions retrospectively; i.e. not only at the time you open those positions.

Supermarket Sweep

It’s not every day you get to buy a company like Tesco at a 35% discount from its all-time high price, and when it has fallen more than 15% in a day. So I did buy it last week, along with Sainsburys. Apparently, even Warren Buffett followed me by topping upon Tesco when he heard that I had 😉

More next week…

That’s it for this week’s news from the Trading Trail. There will be more in about a week’s time.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.