Afren confirms that SEPLAT interested in combination after share price rally

Dec 22, 2014 at 10:27 am in General Trading by contrarianuk

On the 17th December I wrote:

“Nigeria focused Afren, has had an awful 2014 with the share price collapsing 75% in the last 6 months after revelations that its Chief Executive was taking unauthorised payments and production from its key assets have struggled due to technical problems and weather. With high debt and further drilling news not expected until mid-2015, investors have taken fright with the share price dropping to 35p. This company has always been a potential takeover target due to its substantial reserve base and at these sort of levels it is not inconceivable that a larger player could pounce.”

Today Afren’s shares are trading at 55p compared with the 35p level last week, a rise of up to 16% on the day, as the company announces this morning that:

“Afren plc notes the recent movement in Afren’s share price and confirms that it has received a highly preliminary approach from SEPLAT Petroleum Development Company plc regarding a possible combination with Afren. There can be no certainty that an offer will be made or as to the terms of any offer. Afren notes that in accordance with Rule 2.6(a) of the Code, by no later than 5.00 p.m. on 19 January 2015, Seplat must either announce a firm intention to make an offer for Afren under Rule 2.7 of the Code or announce that it does not intend to make an offer for Afren, in which case the announcement will be treated as a statement to which Rule 2.8 of the Code applies. This deadline can be extended with the consent of the Panel in accordance with Rule 2.6(c) of the Code. Further announcements will be made in due course.”

So it seems that the sub $60 a barrel level for Brent Crude and the coinciding crash in small and mid cap oil and gas shares was an excellent opportunity for some very large gains on the bounce in the last few days. I am sure that the potential tie-up between Seplat and Afren is only the start of more M&A activity in the sector. This latest piece of news follows the agreement by Ophir Energy to acquire Asia focused Salamander Energy in an all share deal last month, at a price that many Salamander shareholders felt under valued the company.

The potential risks of oil exploration mean that it now makes considerably more financial sense to buy companies with proven reserves at valuations equating to little more than a few dollars a barrel at current share prices. Wild cat drilling usually has a 1 in 5 chance of success at best and deep water offshore in particular can be extraordinarily expensive. No wonder companies like Ithaca Energy, which is due to double production next year when its Great Stella field comes on stream and Xcite Energy with 257 million barrels 2P reserves have rebounded significantly as the deal making starts.

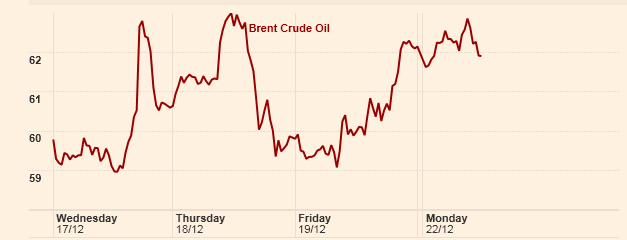

Brent Crude is up close to 1% today at $61.90, after falling to $58.5 on December 16th as comments from the Saudi Oil minister reaffirming his view that the current low prices will be short lived seems to have reassured traders. 2014 has certainly proven to be an incredible year for the oil price. Few had imagined that prices would fall below the $60 a barrel level that’s for sure.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

AS I WRITE THIS ON THE 12 JAN 2015 THE SHARE PRICE HAS DRIFTED BACK TO 0.27 IM HOPING THIS WILL RECOVER TO ITS FORMER GLORY AND FAR EXCEED ITS FORMER GLORY .

DO YOU CONSIDER IT HAS SUCH HOPE , OR ARE YOU EXPECTING FURTHER DECLINES IN THE SHARE PRICE , IF YES IS THERE A REASON TO EXPECT FURTHER DECLINES.