Alibaba comes to market as the world’s biggest technology IPO

Sep 19, 2014 at 3:48 pm in General Trading by contrarianuk

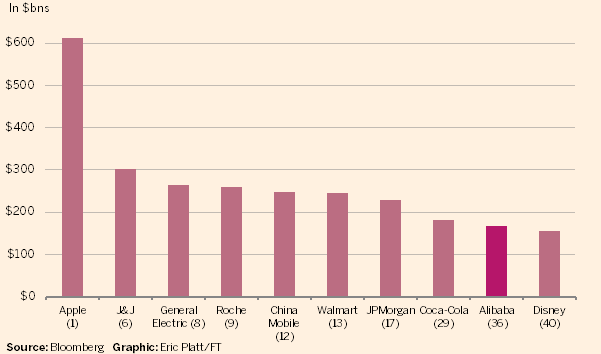

After strong investor demand, Jack Ma’s Alibaba Group Holding Ltd will have their IPO at $68 on the NYSE and will start trading later today, in one of the world’s largest ever initial public offerings, valuing the company at $168 billion. Predictions are for the shares to rise around 30% at the open ($87-92) as many potential investors have been left short on the number of shares they wanted. The IPO price was pushed up from between $60-66 to $68 and values the company’s shares at 34 times its earnings in the twelve months to June 30th. The IPO beats Facebook as the holder of the record for the largest tech offering ever.

Founder Jack Ma will be Alibaba’s third biggest shareholder with 7.8% of the company after the offering with Yahoo owning 16% (down from 22.6% pre-IPO) and Japan’s SoftBank Corp. with a 32% stake having decided not to sell any of its shares, making it the company’s largest share holder. Ma, a former teacher, founded the e-commerce company 15 years ago in a one-bedroom Hangzhou apartment and he will make $867 million from selling shares equivalent to 0.5% of the company.

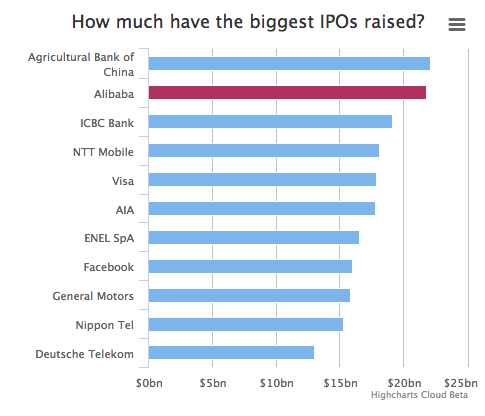

The company founded back in 1999 has raised $21.8 billion, close to the previous record of $22 billion raised by Agricultural Bank of China Ltd. in 2010 and will trade under the ticker symbol BABA. Alibaba’s two week road show included Hong Kong, Singapore, London, New York, San Francisco and Boston and created intense investor appetite for the shares.

There are over 600 million internet users in China, double the United States and this is expected to grow to 850 million in 2015. The Chinese e-commerce market was worth $74 billion in 2010, $295 billion in 2013 and is expected to reach $713 billion by 2017. Alibaba is known for its Chinese market places which allow consumers and businesses to do business and Alibaba makes it easy for money to change hands electronically with 279 million active users, up 50% year on year, and has an 80% share of the Chinese e-commerce market. The average shopper places 52 orders each year.

The company’s Taobao and Tmall marketplaces handled $248 billion in online transactions last year, more than Amazon ($116 billion) and eBay ($87 billion) combined. Alibaba doubled its profits to $1.35 billion in the first quarter of this year, compared with the same period in 2013, and revenues increased 66% to $3.1 billion.

With potentially significant further Chinese growth and huge potential to expand its markets globally no wonder potential investors are paying a big premium for Alibaba’s shares. In its home market Alibaba saw off Ebay and I’m sure Amazon.com and Ebay are a little worried given the huge war chest that the company will have to pursue acquisitions and growth opportunities around the world. Whilst Amazon is still struggling to deliver positive earnings despite its huge revenues, Alibaba already has a healthy margin of over 40%.

But corporate governance concerns remain in common with other Chinese companies and there is inevitably some political risk. For example, the Alibaba Partnership, made up entirely of managers from Alibaba Group, has the exclusive right to nominate candidates for a majority of the board seats and is even allowed to give nominees who fail to gain shareholder approval a board seat anyway.Chinese law forbids foreign ownership of strategic assets in the country so those buying into Alibaba’s initial public offering will only own stakes in a “variable interest entity” registered in the Cayman Islands, that has a contract to share in Alibaba’s profits. Jack Ma has managed to build strong personal relations with China’s ruling elite, and reports pointing to indirect holdings in his company by individuals with strong political connections suggest that Alibaba will keep the establishment sweet.

A big time IPO and very lucrative for early investors including Yahoo. It will be fascinating to see how the end of the first day of trading goes with the investment banks backing the offer keen to avoid a botched Facebook type fiasco. A big pop seems on the cards today with the first trade in the shares having been done at $92.70, a gain of 36%. What will the shares be worth in 12 months time?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.