Apple has another amazing quarter as iPhone looks unstoppable

Jan 28, 2015 at 10:26 am in General Trading by contrarianuk

Yet again Apple and Tim Cook produced another incredible set of earnings and managed to produce the biggest quarterly profit in history.

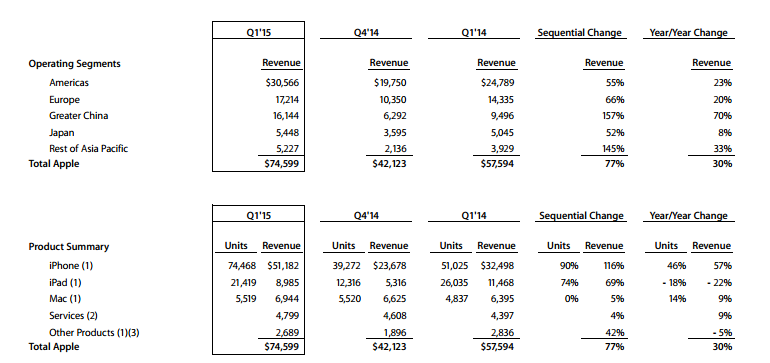

Apple’s revenue rose 30% to $74.6 billion from $57.6 billion and net income came in at $18.0 billion for its fiscal first quarter ended December 27th 2014, up from $13.1 billion in the same period in 2013, a rise of 38%. The previous record was Exxon Mobil’s earnings in 2013 which came in at $15.9 billion.

Earnings per share rose 48% to $3.06 from a split-adjusted $2.07. Expectations were for revenues just shy of $68 billion and earnings of $2.60-2.65 so the numbers were very strong indeed. Gross margin came in at 39.9% for the quarter, up 2% compared to the same period in 2013 and compared with a company forecast of 37.5-37.5% showing the company’s success in upgrading consumers to more expensive models.

The company’s big bet on mobile phones continues to pay off with the new iphone 6 and 6 Plus which were launched in September last year delivering extremely well with 74.5 million units shipped during the quarter compared with estimates of 66 million phones and represented growth of 46% year on year. The success of the new phones came at the end of expense of Samsung and the Android operating system in many key markets including China and the US. “Demand for iPhone has been staggering, shattering our high expectations,” said Tim Cook, chief executive. “This volume is hard to comprehend.”. The surge in iPhone means that the company is close to regaining its status as the biggest smart phone manufacturer by volume as well as value from Samsung. Yet again iPad sales were less impressive with 21.4 million sold during the quarter, an 18% drop versus the same period the year before.

For the current quarter ending March, Apple said it expects revenue of between $53 billion to $55 billion with gross margin of 38.5% to 39.5%. Apple’s cash position at the end of the quarter stood at $142 billion, net of debt. That is almost $23 billion up on three months earlier.

The launch of the Apple Watch in April and the Apple Pay system will be keenly watched over the next few months. With a near 6% rise in the shares pre-market to $115.62 the company’s market cap is now at $663 billion. Investors are sure loving Apple shares at the moment and with results like these who can blame them!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade