British American Tobacco shows things getting tougher at big tobacco

Oct 22, 2014 at 8:46 am in General Trading by contrarianuk

British American Tobacco today issued its Interim Management statement for the period covering the first nine months of 2014 and it wasn’t pretty reading as it reported lower revenue caused by adverse foreign exchange movements and weak volumes in western Europe. The shares of the FTSE 100 company are a favourite with income investors due to their high dividend payments are down 4.5% to 3308p and have been one of the best performing investments of the last decade.

The shares peaked during the summer at around £37 before retreating as it announced a suspension of its £1.5 billion buy-back programme following the announcement on 15 July 2014 that it planned to invest $4.7 billion as part of Reynolds American’s proposed acquisition of Lorillard. The investment enabled BAT to maintain its 42% equity position in the enlarged Reynolds American business.

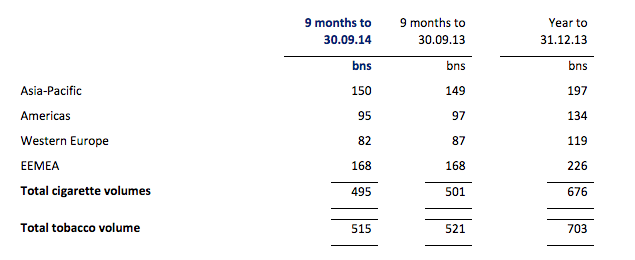

Cigarette volumes have been hit hard in Europe as smokers cut back in the face of health concerns, increased taxation and increased restrictions on smokers in the likes of Russia where a indoor smoking ban was recently introduced. Volumes in Western Europe dropped to 82 billion cigarettes from 87 billion, a drop of 6% in the last year and follows a weak period in 2013. The introduction of plain packaging in Australia has hit margins in the country and its roll out in countries such as Ireland and UK is clearly a concern. Overall volumes dropped 1%, compared with 0.4% fall reported in the first 6 months of 2014. Revenues fell 9.6% overall at the prevailing exchange rates in the nine months ended September 30th and excluding currency effects revenue rose 2.4% due to price increases in some markets. The company said that “The trading environment remains challenging due to continuing pressure on consumer disposable income worldwide and the slow economic recovery in Western Europe. Industry volume has declined at a lower rate than last year, but is being impacted by large excise-driven price increases. Pricing is weighted to the second half of the year, although recent competitive pricing activity in some key markets, notably Australia and Malaysia, and the growth of the low price segment have resulted in some moderation of the improvement in price mix.”

Historically companies like BAT have done well as they have expanded the number of smokers in regions such as Asia Pacific and increased prices in the developed world or moved smokers into premium priced products with higher margins to offset declining volumes in Europe and the Americas. With increasing illicit trade, the introduction of plain packaging and ever rising excise rates the ability of big tobacco to keep profits on track by raising prices is becoming tougher. Alternative products like electronic cigarettes have grown but remain tiny at around $3-4 billion global sales compared with the $400 billion for tobacco. For CEO’s like BAT’s Nicandro Durante it’s becoming more and more about containing costs in the face of falling volumes by streamlining organisations. For income investors, today’s news from BAT gives some concerns about the sustainability of ever expanding dividends and large buy backs which have been the norm over the last decade. Big tobacco is far from dead but things are getting a little tougher.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.