Cairn Energy strikes it lucky in Senegal

Oct 7, 2014 at 8:46 am in General Trading by contrarianuk

Oil and gas explorer, Cairn Energy, hasn’t been having much luck of late. With a tax dispute relating to its remaining interest in Rajasthan focused Cairn India hanging over the company preventing it from selling down its stake any further and a series of poor drilling results in Greenland, the Barents Sea and Morocco its been a rough ride for shareholders in the last couple of years. However, hopes have been raised in recent months that the Cairn India dispute can be successfully resolved after Prime Minister, Narendra Modi, has adopted a far more commercial friendly approach than his predecessors which have helped the shares come off their lows.

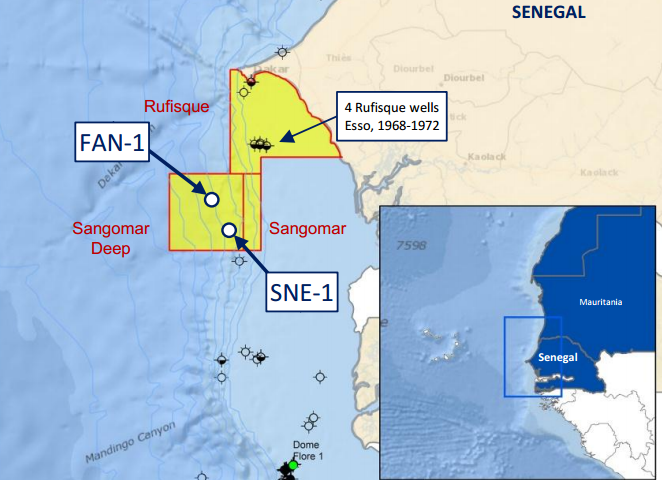

Today Cairn’s shares were up 10.5% to £2 on positive news from Senegal, which is a previously unexplored basin covering 7,490 km2. Cairn has a 40% Working Interest in three blocks offshore Senegal (Sangomar Deep, Sangomar Offshore and Rusifique) ConocoPhillips has 35% , FAR Ltd 15% and Petrosen, the national oil company of Senegal 10%.

FAN-1 was the first exploration well in a two well program, with the wells to be drilled back to back. The first well will be located on the North Fan prospect in 1,500m water depth. This well will be immediately followed by a second exploration well, SNE-1, targeting a shelf edge prospect in 1,100m of water .These are the first deep water wells drilled in Senegalese waters and the first offshore wells to be drilled for over 20 years. The two exploration wells will test combined prospective resources of approximately 1.5 billion barrels of unrisked prospective resources

It was announced today, that the FAN-1 exploration well, has discovered 28° API up to 41° API oil . The well which is approximately 100 kilometres offshore in the Sangomar Deep block had 29 metres of net oil bearing reservoir in Cretaceous sandstones, no water contact was encountered in a gross oil bearing interval of more than 500 metres. Initial gross estimates for the FAN-1 well range from P90, 250 mmbbls, P50, 950 mmbbls to P10, 2,500 mmbbls.

Cairn has no plans for immediate well testing with further evaluation needed to calibrate the well with the existing 3D seismic in order to determine future plans and optimal follow up locations to determine the extent of the discovered resource with further appraisals expected in 2015.

A wildcat has finally come off for Cairn. Shareholders will be hoping for further good news for the next well, SNE-1. Could Senegal be the new West African oil provence that many were hoping for?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.