Where have Capital Spreads clients been placing their trades in H1 of 2012?

Aug 8, 2012 at 11:36 am in General Trading by Dave

Angus Campbell, Chief market analyst at Capital Spreads, provides Spread Betting Magazine readers with an interesting take on just what their clients have been trading this year – were you in the majority or minority?

The first half of 2012 has certainly had its ups and downs and it has been interesting to observe just how our clients have reacted to those trends. When speaking to a fund manager friend of mine just recently, he was proud to relay that he had managed to eke out a gain of 7% for the first half of this year, but

that it felt like he’d been subject to 12 rounds with a heavyweight boxer in order to achieve this! It would be hard to say the same for clients who, on the whole, would have experienced a half of two very different quarters.

In Q1 it can be said that the trading conditions were definitely very conducive to clients’ trading habits, whereas in Q2 the boxing got a little more ferocious…

In what was almost a carbon copy of 2011, we commenced the year slowly grinding higher as investors remained optimistic that the eurozone would muddle through, but then it soon became apparent that Greece was teetering on the edge and close to exiting altogether.

Then we were off to the races as volatility suddenly picked up and a so called ‘Grexit’ looked increasingly likely. For now, however, the country has survived and yet we can’t ignore the fact that the serious issue of Greece’s debt burden and the impact of austerity on her much maligned population could re-emerge at any time as expectations within the markets are still rife that the country will, ultimately, have to leave the eurozone at some point.

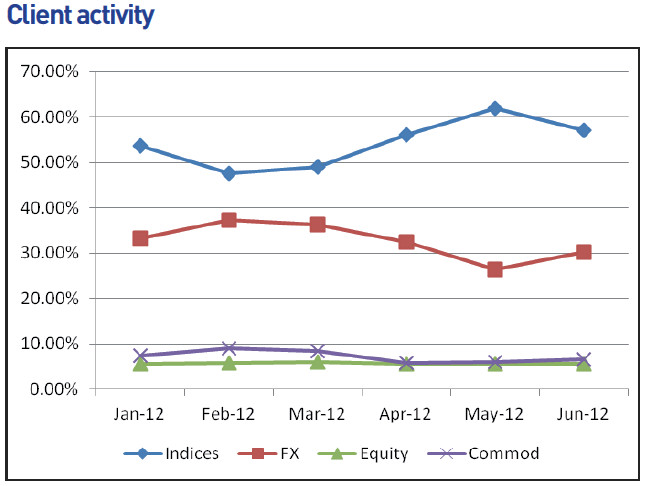

The FTSE 100 remains one of our most popular traded markets and as can be easily deciphered from the graph above, in particular during January and March of Q1, the index ground higher and remained in a very narrow trading range, much like many of the other global markets.

This trend then reversed from March onwards when things in the eurozone started to kick off and which subsequently led to the Greek default yet still managing somehow to remain within the single currency. The resultant volatility in indices attracted many punters back to the likes of the FTSE and Dow with the number of trades in this asset class peaking in May at which point both volatility and fear was at its highest, and that also coincided with the FTSE’s low for the year – an occurrence which typically goes hand in hand, we have observed.

As mentioned, this provided good trading conditions for clients, however, as can be seen from the chart below which illustrates actual client activity; the lack of volatility and ‘excitement’ put off many people who migrated over to currencies to presumably try and fi nd a little more action.

As the markets rebounded towards the end of Q2 and volatility fell away, we saw an almost instant change in client behaviour as they migrated back away from trading the indices into FX once again.

It will be interesting to see just what shape client activity takes for the remainder of the year; in particular with the Olympics about start in earnest and the Great British summer now in full swing (what summer I hear you cry!) as volumes are expected to quieten.

Article reproduced from the August edition of Spreadbet eMagazine