Gold’s recovery in 2014 looks under pressure

Aug 24, 2014 at 8:37 am in General Trading by contrarianuk

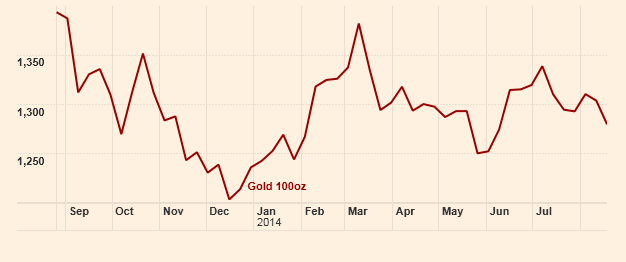

The price of gold fell a staggering 28% in 2013 to finish just over $1200 an ounce, its worst performance since 1981, as investors in exchange traded funds dumped the metal as economic optimism took hold. Gold’s status as a safe haven has largely been out of favour, but prices have rebounded this year with an ounce now trading at $1281. This year prices are up around 6% year to date. Last’s year decline was preempted by the Federal’s Reserve’s decision to begin curtailing its asset purchase programme, benign inflation and booming stock markets around the world.

Our Gold Price Analysis and Forecast for 2014

On Thursday the price of gold fell as low as $1,273 a troy ounce, down around 2% for the week with the threat of higher interest rates in the United States and other economies including the UK the biggest fear as well as a strong US dollar (as the dollar rises, the price of gold falls). Those like Warren Buffett who do not favour investing in the metal since it does not payout of income are even less interested when interest rates begin to rise. For the last few years ultra low interest rates in the developed world have meant that a 0% yield on gold has mattered less, when interest rates begin to rise in the U.S. in 2015, things will be different.

Investors in gold are now hoping that the physical buying from emerging markets helped by factors such as the Indian wedding season will put a floor on prices. Whether this will be enough to boost sentiment and push prices back above $1300 is debatable. The price of gold has remained much more resilient this year than many expected given the ending of monetary stimulus in the United Status. Geo-political factors have played there part, with the Ukraine and Iraq helping gold as some have sought a safe haven in the face of all time highs in many equity indices.

As a contrarian play the odds seem a little stacked against gold right now. The threat of rising interest rates and a stronger US dollar must surely outweigh geo-political considerations.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.