Iron ore at $100 a tonne hits major mining groups

May 18, 2014 at 8:02 am in General Trading by contrarianuk

It felt like the worst could be over for UK listed mining stocks on Monday as a bullish report by JPMorgan Cazenove drove share prices higher with Rio Tinto being the stand out performer as the broker suggested that shareholders could be in line for a cash return of up to $5 billion early next year year. Rio’s shares rose nearly 5% on a change from “underperform” to “outperform”.

JPM said that the second half of 2014 will see “the sector’s free cash flow improvement, capital returns potential and attractive relative valuation begin to be appreciated more fully, we believe this is an opportune time to build exposure ahead of expected second-half outperformance.”

Rio Tinto whose shares were up 4.8% to £33.40, was JPMorgan’s only “overweight” recommendation among the diversified miners.

But the positive mood didn’t last long towards the end of the week, with Rio dropping 2.5% to £32.86 and BHP Billiton falling 1.5% to £19.53 on Friday as the troubles surrounding the price of iron ore continued to plague the large mining groups.

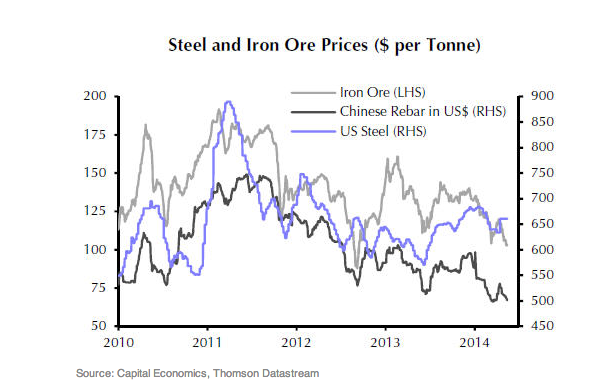

Iron core, used in steel making, is key for Rio, BHP Billiton as well as the Brazilian metals and mining group, Vale. Iron core futures closed at around $100 a tonne on Asian exchanges last week, a fall of nearly 18% over the past year and 23% in 2014 and recent forecasts suggest that prices may remain at these levels or even lower for some time against previous expectations of $110-115 a tonne. The contract for June settlement on the Singapore Exchange dropped as much as 1.6% to $100.65 a metric tonne on Friday, the lowest level for most-active futures since April 2013 and its third weekly drop.

Production of iron ore is on the up even as prices drop, particularly in low cost mines in Australia. BHP Billiton, Fortescue Metals Group and Rio Tinto are planning to add an additional 170 million tonnes of production in Australia in 2014 and Vale is increasing production by 100 millon tonnes of iron ore to 400 million tonnes by 2018. The global surplus will jump from 14 million tonnes last year to 77 million tonnes in 2014 and 145 million tonnes in 2015 according to Goldman Sachs. In effect the big miners are hoping that they can produce enough to offset falling prices to maintain revenues.

The price of iron ore has been going down because of continuing worries about Chinese demand and the concern is legitimate given that it consumes 2/3 of the world’s output. Although China imported 83.39 million tonnes of iron ore in April, the second highest monthly figure on record, domestic consumption remains weak.

The use of commodities in the shadow banking system has also weighed on the price of iron ore and metals like copper. Both metals and ore have been used collateral for short-term financing deals with estimates suggesting that 40% of iron ore inventories are being used for this purpose.

The fall in the price of iron ore has been dampened against a backdrop of record production in the troubled China steel industry which is beset by over capacity. But companies are struggling to cope with falling steel prices with demand from customers extremely weak. China forges as much steel as the rest of the world combined and the globe’s most active steel future , Shanghai rebar, dropped to a record low of Rmb3,130 ($500) per tonne on Friday. 1.82 million tonnes of crude steel were produced in the first 10 days of May, up 1.57% on the preceding 10 day period, according to the China Iron and Steel Association. It is estimated that the Chinese steel industry has 200 million tonnes of excess capacity and pressure to consolidate the sector has been difficult since the plants provide considerable regional revenue and employment.

China remains key to the fortunes of the big mining companies, it will be interesting to see whether JPM’s prediction of big cash return to shareholders takes place. Divestments of non-core assets may well help matters against this backdrop of beaten down commodity prices. Last week BHP Billiton announced it was reviewing a potential sale of its nickel business which could fetch up to $700 million after already divesting around $6.5 billion of assets over the last 2 years. BHP’s Nickel West business is made up of three mines and associated smelters and refineries in Western Australia. Unlike the problems of the iron ore price, nickel was trading at $21,625 a tonne earlier this week, a level last seen in February 2012 with prices rising sharply this year as the Indonesian government banned ore exports that removed the ore for a third of global nickel production.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.