McDonalds continues to suffer consequences of dodgy Chinese suppliers

Sep 9, 2014 at 1:36 pm in General Trading by contrarianuk

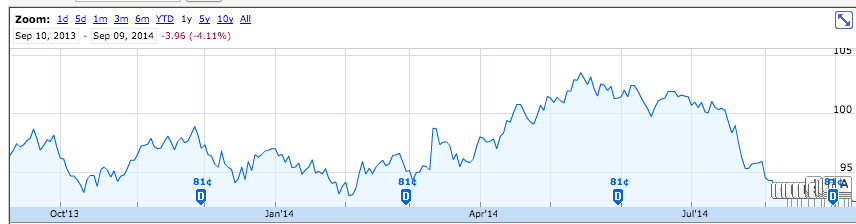

McDonalds is having a tough time of late with the shares down over 10% since the end of last year as Chinese food safety concerns in particular have hit sentiment. The shares are trading at $92 compared with the December high of $103 but still way up on the $58 hit in 2009. The company is the third worst performing share in the Dow Jones Industrials this year.

McDonalds is having a tough time of late with the shares down over 10% since the end of last year as Chinese food safety concerns in particular have hit sentiment. The shares are trading at $92 compared with the December high of $103 but still way up on the $58 hit in 2009. The company is the third worst performing share in the Dow Jones Industrials this year.

Today it released its sales figures for August and its pretty grim reading for the investors. Global sales fell 3.7% compared with expectations of a 3.1% drop with the Asia, Middle East and Africa region down 14% after diners stayed away due to worries about the safety of meat being supplied by third parties in its Chinese restaurants. Problems were first identified in July with meat supplier Shanghai Husi Food Co., owned by U.S.-based OSI Group LLC.

But more concerning for the company is that it wasn’t just Asian diners that have stayed away with US sales down 2.8% and Europe falling 0.7% hit by a downturn in Russia. Commentators worry that whereas strained house hold budgets attracted customers after the last financial crisis, the chain is now losing its relevance in an increasingly crowded casual dining sector. The company was lambasted in 2004 after the film “Super Size me” which featured Morgan Spurlock eating just McDonald’s meals and asking them to be super sized over a one month period. As a result, Spurlock gained 24½ lbs. (11.1 kg), a 13% body mass increase, with a cholesterol level of 230. As a consequence the company tried to reinvent itself, introducing new menu items and upgrading its restaurants. The strategy worked for a long time but recently the problems in China have exposed worries that the company’s growth days may be behind it as consumers become increasingly health focused and tempted by competitive offers particularly in its home market. Trust in the safety of its food has clearly been shaken despite the company’s efforts to minimise the fall out from its Chinese supply chain.

There’s no sign that the era of the Big Mac is over, but time will tell whether the setbacks in China are long lasting and whether American diners can be tempted back to gorge on those burgers and fries. Super sized growth is looking elusive for the American giant.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.