Twitter shares due for first earnings report after big hitting IPO

Feb 5, 2014 at 12:34 pm in General Trading by contrarianuk

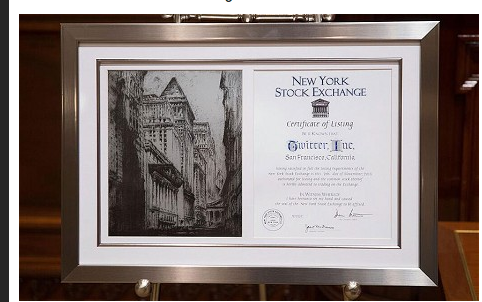

Twitter (TWTR) shares had their IPO on the NYSE on November 7th 2013, with an IPO (Initial Public Offering) price of $26, valuing the company at $14.2 billion. On the first day of trading they closed at $44.90, up more than 72% on the day. Today they trade at $66 valuing the company at $36 billion.

After the market close today, Twitter will report its fourth quarter 2013 earnings and mighty interesting they will be too! Expectations are for a loss of 2 cents a share, on revenue of $218 million. It will be the first earnings announcement since the company’s successful IPO.

Twitter allows its users to tweet messages which are limited to 140 characters. The short nature of tweets makes them perfect for on-the-go mobile use and for social purposes. Users are increasingly using Twitter as a search engine and as a way to gather and read up to the minute news quickly.

Many analysts believe it is hideously overvalued but its price has become caught up in a whirlwind of positivity regarding internet stocks following strong Google and Facebook earnings. But with more than 230 million users and an expanding advertising platform some believe that Twitter has plenty of reasons not to sell it at these prices despite high R&D and operating expenses.

There will be focus on the number of active users, which is expected to have grown significantly from 160 million in 2012 to 230 million today and a sharp increase in 2013 revenues to around $630 million and EBITDA around $50 million.

The company recently launched a “Tailored audiences” feature for advertisers which improves targeting and theoretically should improve revenues for Twitter. The platform itself is perfectly suited to mobile and this is where the users increasingly are moving, away from desktop solutions. Due to the “retweet” feature and the viral nature of the platform, ads can get distributed to a much larger audience for no additional cost.

Certainly Twitter looks like its here to stay and although I may not love the shares at this price, I love the company’s product – fantastic for financial news.

Note: Aftermath: EPS $0.02, against an estimate of -$0.02 however the stock is sharply down after-hours due to a lower number of active users growth which stood at 241 million monthly active users.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.