McClellan Oscillator And Index

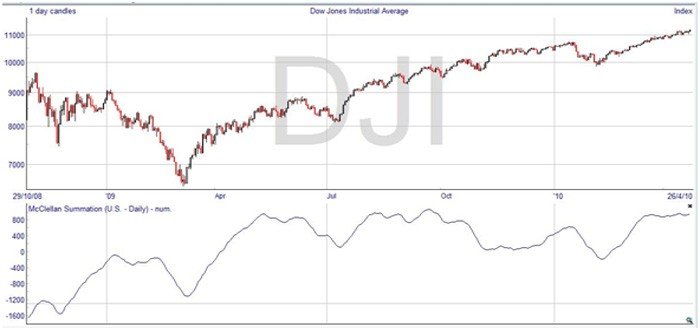

The McClellan Oscillator was invented to provide overbought/oversold indication based on the A/D lines. It’s worked out by taking the difference between two EMA’s of the advance-decline figures. The actual periods used are 19 days and 39 days. It oscillates around zero, with the extremes at +100 and -100. If it is +100, the market is considered overbought, and if it is -100 then the market is oversold. Crossings of the zero line can also be used for buying and selling signals. Here’s the DJIA with the McClellan Oscillator added.

The McClellan Oscillator is used for trading on a short to medium term basis. McClellan also invented the McClellan Summation Index which is used for longer-term review of market breadth. It’s the running total of the McClellan oscillator daily values.

The McClellan Summation Index gives a long range view of market breadth, and can be used to find major turning points.