Croda is a British chemical group which is succeeding in astounding the pundits with its growth. It is based in Yorkshire and has become known for its natural based chemicals used in personal care products, even though its range of products extends far beyond this, including crop production, lubricants, polymers, cleaners and industrial chemicals.

The company started in 1925 initially to manufacture lanolin. It was listed on the Stock Exchange in 1964, and expanded quickly in the 60s by acquisition. The products are now made in many countries around the world.

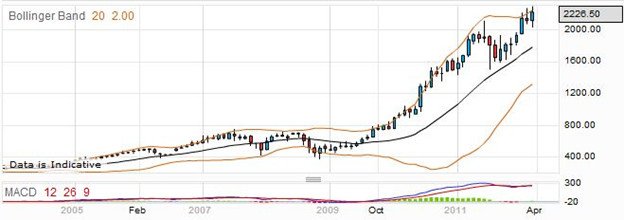

Here is a monthly price chart showing how the company has grown in recent years: –

Croda has been expanding recently into more specialized chemicals, and has struck a deal with ICI for its Uniqema.

The company’s focus has been on converting natural materials such as vegetable oils and fats into fatty acids and glycerol, and then adapting the products for a range of functions, including surfactants, dietary supplements such as omega-3, for which Croda is one of the world’s leading suppliers, and fatty acid amides which provide more slipperiness to plastic surfaces.

Croda has also developed its own processes, mainly in the search for higher levels of purity for its cosmetic and pharmaceutical chemicals. However, throughout all this development and expansion, the original purpose of extracting lanolin, the natural protective which is present in sheep’s wool, has been maintained and Croda is still the world’s number one producer of lanolin.

You can see from the chart above that Croda has been on a “tear” at least until recent months. The global economic recession of 2008 is barely a blip, which reflects the basic nature of the products which Croda produces, and which the world is always willing to purchase.

Spread Bet on Croda International: Rolling Daily

Croda International has been rapidly expanding in recent years, and the current rolling daily spread betting price is 2236 – 2246. If you think that the price will continue to rise, then you may consider placing a long bet at the buying price of 2246, staking perhaps £3 per point. As it is a rolling daily bet, there may be a small charge to your account made each evening when the bet is rolled over to the following day, but if you hold the bet for a few days or weeks it is usually not significant.

If you are correct and the price continues to go up, you might find that it reaches 2415 – 2425 in a few weeks, and you may decide to cash in and take your winnings. Working out what you have won, the long bet is closed on the lower price of 2415 which means that the number of points you have gained is 2415-2246, or 169 points. With a stake of £3 per point, you have won £507.

Any time that you place a bet on the financial markets, you must be prepared for it to lose. Perhaps the price went down after you placed your bet, and you closed the spread bet to prevent any further losses when the price reached 2122 – 2132. This time the point difference is 2246 less 2122, which is 124 points. That means you lost £372.

Many traders use the stop loss order to keep a watch on the market for them. It tells your spread betting provider to close your bet once the price goes against you to a certain level. Say you had a stoploss order on this bet, and the spread trade was closed at 2196 – 2206. In this case you have lost 2246-2196, or 50 points. That means you lost £150.

Croda International Futures Based Bet

Looking to the intermediate term, you might decide to place a futures based bet on Croda International. The current price offered by your spread betting provider is 2252 – 2264. If you think that the price will go down in the next few months, then you could place a short bet, selling at 2252 with a stake of £2.50 per point. Although it is a futures based bet, you can close it at any time, either because you have achieved as much profit as you think you can, or because the price has gone against you as far as you are prepared to lose.

Considering first that your bet may be profitable, perhaps the price goes down to 2076 – 2087 and you close the spread trade and take your profit. You have made 2252 less 2087 points, which is 165 points. For your chosen stake, that amounts to £412.50.

But the price might have gone against you, and at some point you would have to decide to cut your losses and close the spread bet, even though it would cost you money. Perhaps it goes up to 2387 – 2399, and you decide that you cannot take any more loss and close your trade. Once again, the short bet closes on the higher price, which in this case is 2399, so the number of points you lost is 2399-2252. That’s 147 points, for a loss of £367.50.

It is often worth placing a stop loss order when you take out your initial bet. This means that your spread betting provider will close the spread bet for you if/when you lose a specified amount. In this case, the stop loss order might have closed your spread bet when the price reached 2321 – 2333. Calculating your losses again, 2333-2252 equals 81 points, so you would lose £202.50.